US-Tariffs Hit Automotive Suppliers: Why Staying Competitive Means Producing in Mexico

Since the beginning of the second Trump administration in January 2025, the global trade market has been in turmoil. The U.S. president has introduced import tariffs on various products with the aim of strengthening the domestic economy. Particularly, the automotive industry has been affected, facing far-reaching trade restrictions.

The tariffs, in effect since April 2025, have led to significant price increases for consumers and substantial profit losses in the vehicle industry. Against this backdrop, the United States-Mexico-Canada Agreement (USMCA) is gaining enormous importance for the strategic realignment of the automotive sector. By reorganizing supply chains within North America and increasing the regional share of production, tariffs can be reduced or even completely avoided.

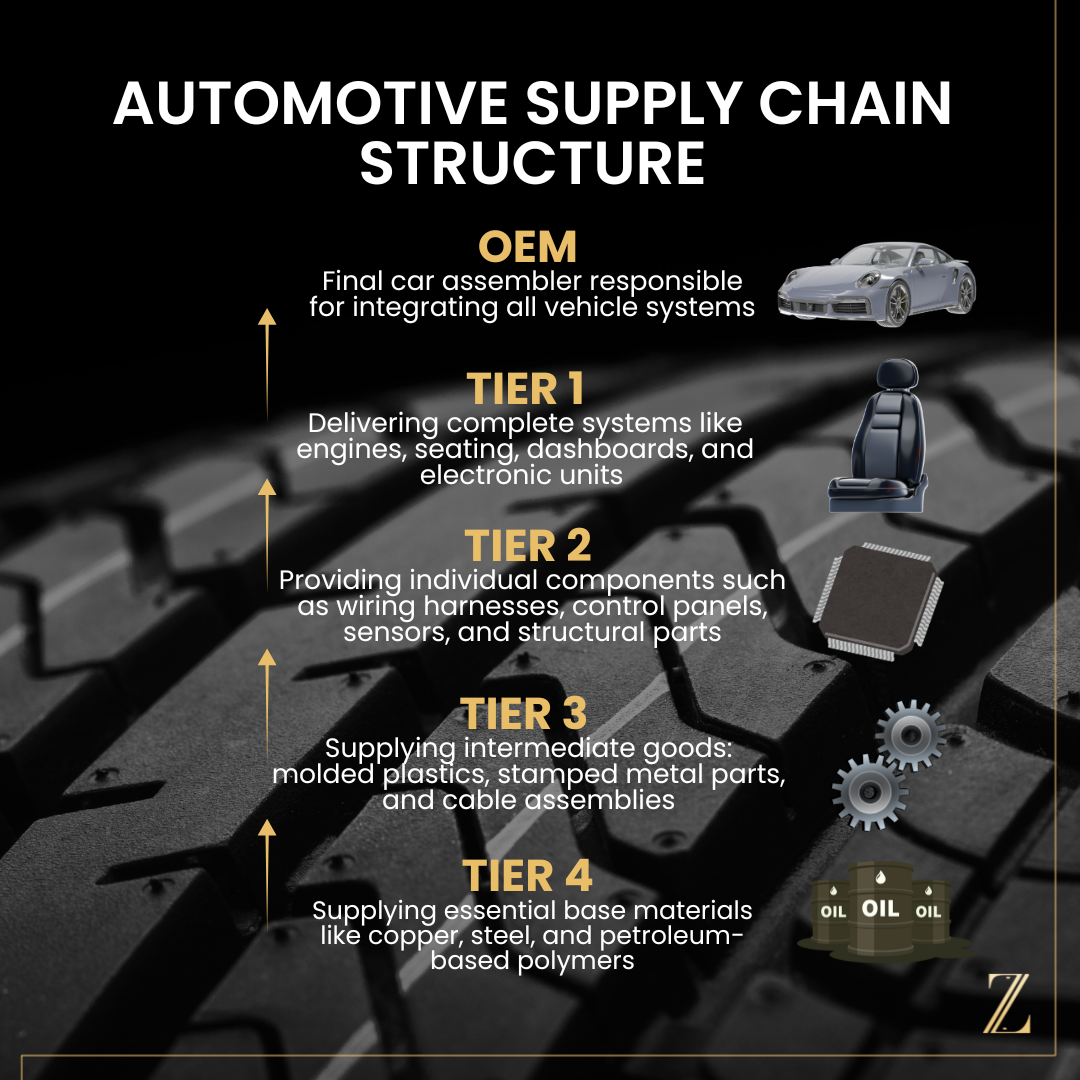

The Mexican market plays a key role, since it has been a hub for the industry for many years. Specifically, OEMs and Tier 1 suppliers are attempting to shift their previously European supplier structures into the USMCA trade zone.

To understand the current market dynamics and possible future movements of the industry, it is worth taking a look at the development of the North American trade zone, the transition from NAFTA to USMCA, and today's cross-border supply chains.

From NAFTA to USMCA

As early as 1989, the first free trade agreement between the United States and Canada entered into force, laying the groundwork for a broader North American integration. Mexico, which had been undergoing economic liberalization since the 1980s, soon expressed interest in joining a trilateral free trade zone. With the signing of the North American Free Trade Agreement (NAFTA) in 1993, this objective became reality. The agreement granted Mexico access to the world’s largest economy and promised an increase in national prosperity through direct investment from the United States.

When NAFTA came into effect on January 1, 1994, it opened a new chapter of economic cooperation between the United States, Canada, and Mexico. Its aim was to create a free trade area that would reduce tariffs and other trade barriers in order to promote economic growth, investment, and the global competitiveness of the North American member states.

The U.S. also hoped to achieve security benefits from Mexico's integration alongside the economic ones. Reducing the wealth gap between the countries was expected to make illegal migration less attractive. In addition, Mexico offered a low-wage production environment that could be strategically leveraged in the face of competition from Asian markets. Relocating production facilities was expected to boost the international competitiveness of U.S. industries. A key element of the agreement was the duty-free import of automotive products from Mexico into the U.S., provided they met a regional value content (RVC) of at least 62.5%.

In the following years, the economies of all three member states grew significantly. Mexico in particular, benefited from the creation of numerous industrial jobs, especially in the automotive sector. By 2018, nearly all vehicles imported from Mexico and Canada into the U.S. met the regional value content requirement. However, criticism—especially from the Republican camp—grew over time: roughly one-third of jobs in the U.S. automotive industry were lost after NAFTA came into effect. Critics blamed this on the relocation of production to Mexico. In fact, however, less than 5% of job losses could be directly attributed to trade with Mexico, as many positions were eliminated through automation.

With the inauguration of President Donald Trump in his first term in 2017, a key campaign promise was fulfilled: the renegotiation of the North American trade agreement. The result was the United States–Mexico–Canada Agreement (USMCA), which entered into force on July 1, 2020. Substantively, it was largely a revision of NAFTA with some new elements, particularly in the automotive sector. For example, the required regional value content was raised to 70–75%. In addition, 40–45% of this value must come from workers earning at least USD 16 per hour (Labor Value Content, LVC). This provision was intended to shift more production to the U.S. and Canada and reduce Mexico’s attractiveness as a low-wage location.

Development and Current Situation

Five years after its implementation, it can be observed that the agreement has led to a moderate increase in jobs and investments in the U.S. industrial sector. However, it has not produced significant macroeconomic effects on GDP.

Under NAFTA, 0,2% of vehicle imports from Mexico and Canada were subject to tariffs. By 2023, this share had risen to 8.2%. This noticeable increase suggests that many companies are either unable or unwilling to comply with the new USMCA rules of origin. Rather than shifting their complex global supply chains to North America through multibillion-dollar investments, they prefer to accept the relatively low punitive tariffs of around 2.5%.

With Donald Trump’s reelection and the beginning of his second term in January 2025, the president once again made tariffs a central issue. Referring to the USMCA—an agreement he himself signed—Trump stated: “Who would ever sign a thing like this?”, criticizing that only Mexico and Canada were benefiting from it.

As part of his campaign platform, Donald Trump announced a series of sweeping trade measures aimed at strengthening the U.S. domestic economy. On March 4, 2025, he imposed a special 25% duty on most imports from Canada and Mexico—excluding products that comply with USMCA rules of origin. He later expanded tariff measures globally, introducing sector-specific tariffs of up to 25% on automobiles and up to 50% on metal products, citing Section 232 of the Trade Expansion Act. To justify broader trade restrictions, he also invoked the International Emergency Economic Powers Act (IEEPA), implementing worldwide tariffs ranging from 10% to 50%, while maintaining the original 25% rate specifically for Canada and Mexico.

In a more recent announcement on July 12, 2025, Trump proposed increasing tariffs on Mexican imports from 25% to as much as 30%, with implementation planned for August 1, 2025. Whether this hike will take effect remains uncertain, as similar measures have often been renegotiated or withdrawn before enforcement.

New Opportunities Through USMCA Protection

While these tariffs are officially framed as global measures, they have sparked significant concern over the stability and resilience of North American supply chains—particularly in the automotive sector, where cross-border integration is deeply embedded. So how exactly will these new trade barriers affect the industry? And what are the implications for manufacturers operating under the USMCA framework?

European OEMs and Tier-1 suppliers, who have so far relied heavily on global supply chains, are under increasing pressure due to these newly imposed tariffs. Section 232 and IEEPA sanctions are resulting in higher import costs for materials sourced from third countries—as well as from Mexico and Canada. Importantly, Trump clarified that the newly proposed 30% tariff would not apply to the automotive sector, which remains subject to the existing 25% sectoral duty.

One way to mitigate these tariffs is by manufacturing in accordance with USMCA rules—that is, meeting both regional value content and Labor Value Content requirements. If a product qualifies as USMCA-compliant, it can be imported into the U.S. at significantly reduced tariff rates and the new trade barriers do not apply.

If a vehicle is being imported into the United States and the importer wants to benefit from lower tariffs under the United States-Mexico-Canada Agreement (USMCA), specific origin rules must be met—not just for the entire vehicle, but also for individual parts. This includes meeting the required levels for Regional Value Content and Labor Value Content. Only when these requirements are satisfied are the parts considered USMCA-compliant—and only the portion that comes from outside North America is subject to tariffs.

OEMs and Tier-1 suppliers have had a strong presence in Mexico for many years. In light of the current situation, many are now strategically reorienting their supply chains, focusing increasingly on production and sourcing within the North American region in order to meet Local Value Content requirements.

This development presents an opportunity for Tier-2 to Tier-4 suppliers. Many companies in these tiers do not yet have a presence in North America—creating a gap that OEMs and Tier-1s are now trying to close. Local investments and relocations could offer a crucial competitive edge. Building up local supply structures not only strengthens competitiveness but also reinforces the overall resilience of the supply chain—especially in light of ongoing geopolitical tensions.

A Look Ahead

The shift of supply chains to the North American continent presents significant market entry opportunities, especially for Tier-2 to Tier-4 suppliers. In the short term, however, this transition involves certain challenges. For instance, production costs are generally higher in North America compared to most Asian countries. Another factor is the seemingly unpredictable U.S. tariff policy: tariffs are often announced on short notice, particularly under the Trump administration, and then subsequently postponed, renegotiated, or suspended.

At the same time, this pattern reveals a broader strategic reality: the U.S. recognizes how important supply chains in Mexico and Canada are for its own economic growth and industrial strength. Even when tariffs are initially announced, they are rarely fully implemented—underscoring the value placed on stable trade relations within North America. Looking ahead, it is likely that any new tariffs targeting Mexico or Canada will be revised or withdrawn before they actually take effect.

Nevertheless, a degree of uncertainty remains due to the broader political environment. Trump’s current term ends in early 2029, and it is still unclear what direction U.S. international policy will take thereafter. In terms of trade policy in particular, it is unclear whether the current protectionist stance will persist or be replaced by a more open, cooperative approach.

In the long term, however, the advantages of a North American supply chain outweigh the challenges. U.S.–China relations remain tense, and current forecasts suggest further deterioration rather than improvement. Other Asian countries are also losing attractiveness, as they lie outside the United States’ geopolitical sphere of influence and therefore represent a greater strategic risk.

In contrast, Mexico and Canada benefit from their integration into the U.S. trade ecosystem. The risk that additional tariffs or trade barriers will be imposed on Asian “low-cost” countries is higher than new restrictions being placed on Canada or Mexico. This makes North American production locations not only economically viable but also strategically more secure.

At the same time, the cost advantage of low wages in Asia is diminishing due to increasing automation. In manufacturing—particularly in the automotive industry—factors like material availability, reliable delivery times, and overall supply chain resilience are now taking precedence over labor costs alone. This shift began years ago but gained significant momentum during the Covid-19 pandemic, which exposed the vulnerabilities of distant supply chains. As a result, the concept of "nearshoring"—locating production closer to the end consumer—has emerged as a key strategy for global companies aiming to increase flexibility and reduce risk.

Conclusion – Consider Expanding Into Mexico

The Trump administration's renewed tariff offensive has disrupted global supply chains and forced the automotive industry—especially European OEMs and Tier-1 suppliers—to rethink their strategies. The key takeaway: North America, and particularly Mexico, is emerging as the central hub for future-proof automotive production. To bypass tariffs and remain competitive, companies are increasingly shifting operations to comply with USMCA regulations.

This realignment presents significant opportunities for Tier-2 to Tier-4 suppliers to step in and address existing gaps within the North American supply network. While short-term uncertainties and increased production costs remain a challenge, the long-term advantages—greater regional integration, enhanced supply chain resilience, and reduced geopolitical exposure—clearly outweigh the risks. The move toward production in the USMCA is no longer optional—it's a strategic imperative. If you don’t expand with your own production to North America right now, your competitors might, and you’ll lose your clients on the continent.

How Zeitgeist Helps You

If you're exploring the opportunity of entering the Mexican market, it's crucial to understand the regional differences that can shape your success. Labor costs, infrastructure, and supply chain access vary significantly across the country — in some regions, costs may rival those in parts of Asia, while in others, they approach U.S. levels.

At Zeitgeist Consulting Group, we help international companies make well-informed decisions through detailed location analyses based on more than 90 hard and soft location factors. We tailor our insights to your operational needs, ensuring your investment is both efficient and strategically positioned.

Additionally, our collaboration with P3 — a trusted partner with deep expertise in the automotive sector and technical know-how — allows us to support your expansion by navigating complex tariff structures, ensuring compliance with USMCA requirements and having a smooth ramp-up of operations from day one. And if your company is already operating in Mexico, we can help assess and optimize your supply chain localization strategy to strengthen your regional footprint.

Don’t wait for the competition to make the first move.

Reach out to us for an initial consultation, and let’s explore how your company can thrive in Mexico and North America.

References

Renshaw, J., Acharya, B., & Garrison, C. (2025, July 13). Trump intensifies trade war with threat of 30% tariffs on EU, Mexico. Reuters. https://www.reuters.com/business/trump-announces-30-tariffs-eu-2025-07-12/

The White House (2025a) Fact Sheet: President Donald J. Trump Restores Section 232 Tariffs. Available at: https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-restores-section-232-tariffs/

The White House (2025b) Fact Sheet: President Donald J. Trump Imposes Tariffs on Imports from Canada, Mexico, and China. Available at: https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china/

Thompson Hine LLP (2025) Section 232 Aluminum and Steel Tariffs Increased to 50% Except for UK; Significant Changes Made to Calculating and Stacking of Tariffs. Thompson Hine LLP. Available at: https://www.thompsonhinesmartrade.com/2025/06/section-232-aluminum-and-steel-tariffs-increased-to-50-except-for-uk-significant-changes-made-to-calculating-and-stacking-of-tariffs/

The Economic Times (2024) US News: ‘Who would sign a thing like this?’ – Donald Trump accidentally insults himself, slams trade deal US-Mexico-Canada Agreement. Available at: https://economictimes.indiatimes.com/news/international/global-trends/us-news-who-would-sign-a-thing-like-this-donald-trump-accidentally-insults-himself-slams-trade-deal-us-mexico-canada-agreement/articleshow/118608791.cms?from=mdr

Peterson Institute for International Economics (2014) PIIE Briefing 14‑3: NAFTA 20 Years Later. Washington, DC: Peterson Institute for International Economics. Available at: https://www.piie.com/publications/piie-briefings/nafta-20-years-later

USTR (2024) USMCA Autos Report to Congress. Office of the United States Trade Representative. Available at: https://ustr.gov/sites/default/files/2024%20USMCA%20Autos%20Report%20to%20Congress_0.pdf

Gehring, H. and Kleider, H. (2004) NAFTA und das Freihandelsabkommen Mexikos mit der Europäischen Union – Ein Vergleich. Konrad-Adenauer-Stiftung. Available at: https://www.kas.de/de/web/auslandsinformationen/artikel/detail/-/content/nafta-und-das-freihandelsabkommen-mexikos-mit-der-europaeischen-union-ein-vergleich